What Homebuyers Need To Know About Credit Scores

Some Highlights

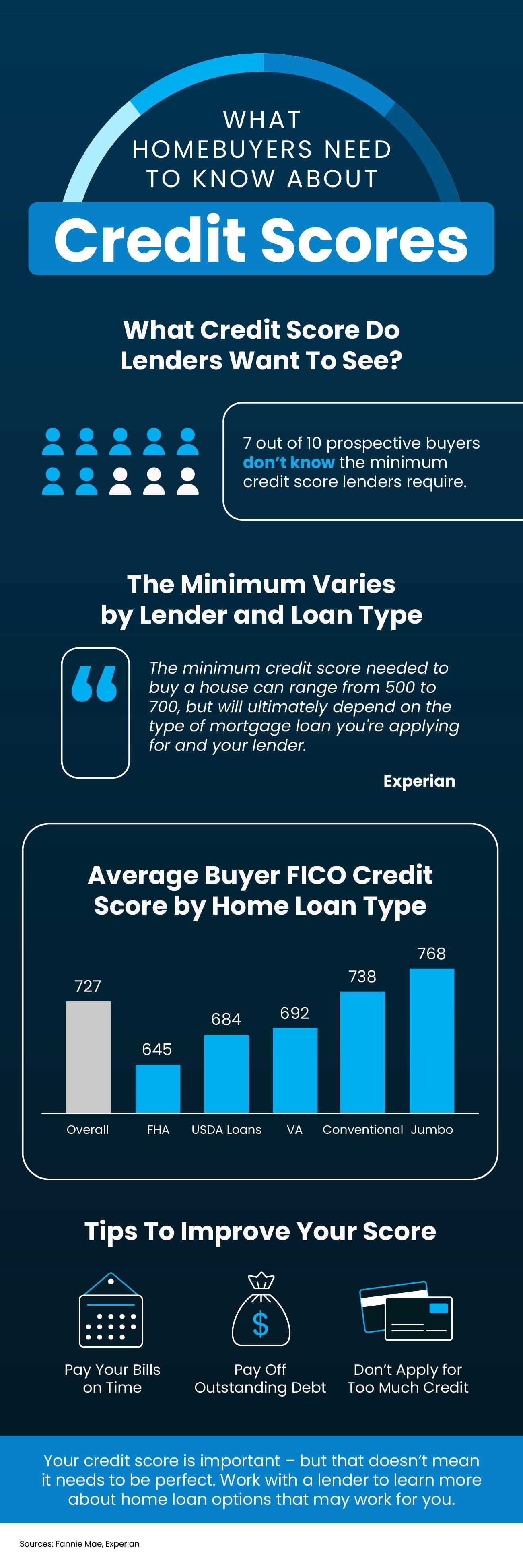

- Data shows 7 out of 10 prospective homebuyers don’t know the minimum credit score required by lenders or that it varies by lender and loan type.

- According to Experian, the range is anywhere from 500 to 700 for the minimum credit score. That means you don’t need perfect credit to buy a home.

- Your credit score is important – but that doesn’t mean it needs to be perfect. Work with a lender to learn more about home loan options that may work for you.

Categories

- All Blogs (692)

- Baby Boomers (1)

- Buyers (1)

- Buying Myths (4)

- Demographics (1)

- Distressed Properties (1)

- First Time Home Buyers (8)

- For Buyers (21)

- For Sellers (15)

- Foreclosure (2)

- Housing Market Updates (19)

- Infographic (4)

- Interest Rates (3)

- Move-Up Buyers (5)

- New Construction (2)

- Pricing (9)

- Rent vs. Buy (2)

- Selling Myths (3)

- Senior Market (1)

Recent Posts

This May Be the Best Time To Buy a Brand-New Home

Why More Homeowners Are Giving Up Their Low Mortgage Rate

The 3 Housing Market Questions Coming Up at Every Gathering This Season

How To Find the Best Deal Possible on a Home Right Now

Why So Many People Are Thankful They Bought a Home This Year

Why Buying a Home Still Pays Off in the Long Run

4 Reasons Your House Is High on Every Buyer’s Wish List This Season

Most Experts Are Not Worried About a Recession

The Top 2 Things Homeowners Need To Know Before Selling

The Housing Market Is Turning a Corner Going into 2026

I have been selling all types of real estate since 1991. My consistent ranking in the top 5% of the nation among my peers, speaks to my level of expertise and dedication. I strive to stay on top of the latest trends and techniques in the constantly evolving world of real estate and offer the best customer service possible.